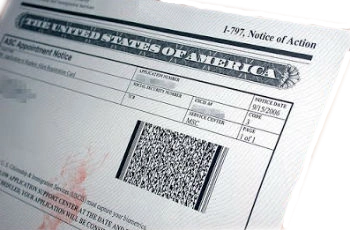

Non-Permanent Resident Program

Access to housing with qualifying work VISA

Conventional

Just because you’re not a U.S. citizen doesn’t mean home ownership is out of reach. Lawful permanent or non-permanent residents can apply for loans just the same as citizens

Clear Lending offers mortgage programs for non-permanent residents that might be right for you.

With the Non-Permanent Resident Program, we can help those professionals working in the US with a valid social security number and evidence of an acceptable visa. Acceptable Visa includes E Series (E-1, E-2, E-3), H Series (H1-B, H1-C, H-2, H-3, H-4), L Series (L-1A, L-1B, L-2), O Series (O-1) and NATO (TN-1 and TN-2).

Provide a copy of the employer's letter of sponsorship for visa renewal if a borrower(s) visa will expire within six months of the loan application, and the borrower has not changed employers.

Get today's lowest mortgages rates.

Non-Permanent Resident program borrowers are still subject to Fannie Mae or Freddie Mac's automated underwriting systems with at least one valid credit score to be eligible.

If you want to purchase your dream house and have any of the permits mentioned above, Clear Lending can help you. Simply apply online, and we will contact you right away to review the best options for you.

Don't wait any longer and find out how much loan you can get Pre-Approved.

Whether you are considering purchasing or refinancing an existing mortgage loan, Clear Lending can help you. Simply complete our secure and encrypted Pre-Approval Form online, and we will contact you right away to review the best options for you.

Not all applicants will qualify. This advertisement is not an offer for an extension of credit. Please meet with a licensed loan originator for more information as programs are available only to qualified borrowers. Programs rates, fees, terms, and programs are subject to change without notice. Not all loans, loan sizes, or products may apply. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet loan-to-value requirements, and final credit approval. Approvals are subject to underwriting guidelines and program guidelines and are subject to change without notice. Some restrictions may apply.

Customers Reviews:

-

Guillermo Proestakis • October 15, 2018

FROM GOOGLE: Muchísimas Gracias ! No existen palabras para expresar tanto agradecimiento. Solo destacar el profesionalismo y dedicación de vuestra empresa y sobretodo a Joan quien nos acompañó en todo momento en este largo proceso. Gracias Joan por hacer realidad este gran sueño “nuestra casa” , y por ayudarnos a forjar los maravillosos momentos que formarán nuestra historia. Esperamos seguir siempre en contacto y sobretodo con nuestro eterno agradecimiento. Guillermo Proestakis y Familia.

-

Erica Proo • March 26, 2018

Joan is a phenomenal person who took the time to explain in detail the entire loan process and what to expect! His knowledge and dedication made me feel comfortable as a first-time home buyer with a teacher salary. He was there from beginning to closing and even after! Without hesitation, I would seek him again for his services. Highly regarded and HIGHLY RECOMMENDED.

-

Ivan Martinez • December 22, 2023

Clear Lending helped me to buy my first home and now I just bought my second home. I did not hesitate to contact them again. Joan & Patricia answered all the questions and followed up on my case for a couple of years until I was ready to buy my second home . Thank you for all your support. Merry Christmas.